Explanation of Benefits

How much do I have to pay?

What is an explanation of benefits?

An Explanation of Benefits (EOB) is a statement your insurance company sends you showing what was billed, how much they paid and how much you are expected to pay.

• These days almost all insurance companies let you view a claim online.

The EOB may not always be downloadable but the claims details are usually visible.

Viewing online allows you to catch a mistake before a paper copy of the EOB reaches you.

• You need to review the EOB and compare it to any bill you may have received from the provider.

The provider’s bill needs to match the EOB, especially the amount you’re responsible for.

Many times your will receive a bill from the provider before the EOB reaches you.

♦ Never pay the provider’s bill until you have compared it either with the paper copy of the EOB or your insurance company’s online information.

The Affordable Care Act has a provision to establish common health insurance terminology.

The goal was to make it easier to understand EOBs. That has not really happened, yet.

How to read an explanation of benefits

At this time, EOBs do not all look the same. The link below will take you to an expand view of the EOB below.

Important areas are identified by number followed by a description.

How to read an Explanation of Benefits

If you understand these terms you will have a firm foundation to understand how to read an EOB and what to watch out for.

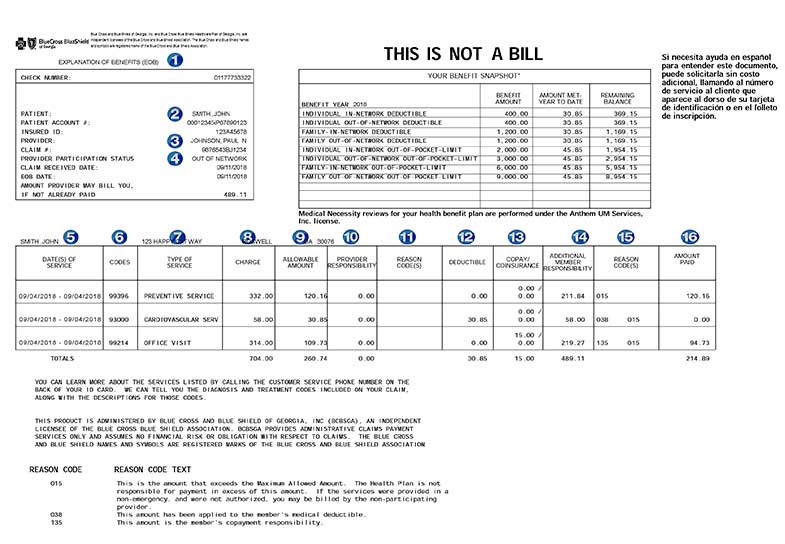

1. Explanation of Benefits (EOB) – notice This Is Not A Bill

2. Your name – confirm this is correct.

3. Provider’s name – Is this the provider you saw?

The image on this page is an EOB. It is a true example of a mistake made by the doctor's billing office.

The doctor's office submitted the bill in the name of a different doctor. Someone who is not in the plan’s network.

This caused the claim to be processed as out-of-network resulting in much higher costs to the Mr. John Smith. …. This is not the insurance company's mistake.

If you see this mistake you must ask the provider to correct this and resubmit their claim.

4. Out Of Network – Mr. Smith knows his doctor is in-network – seeing this is a red flag.

5. Dates of Service – The dates must match the days Mr. Smith received the services.

6. Codes – these are billing codes called CPT codes. Google CPT 93000, it is for an EKG.

Be sure you received all the services the EOB lists.

7. Type of Service – this is a general description, CPT codes are more exact.

Mr. Smith is being charged for a physical, which includes an office visit.

The provider is trying to push through a separate office visit.

♦ The separate office visit is a form of up-charging. It could be justified if additional time was spent discussing a specific issue.

Mr. Smith knows this was not the case. He can complain to his insurance company but in the end it will be the word of the doctor's office against his.

8. Charge – the full amount billed

9. Allowed Amount – since this provider is out-of-network this amount is the maximum Mr. Smith's plan considers Reasonable and Customary.

This amount is what the insurance company considers normal or reasonable in Mr. Smith's geographical location.

If the provider was out-of-network the doctor would not have to accept this amount as full payment (if in-network he would have to accept this amount).

The provider can and probably will bill Mr. Smith for the remainder. This is called balance billing.

♦ This claim needs to be reprocessed with the correct doctor's name.

10. Provider Responsibility – how much the doctor would need to write-off or discount.

If the provider was in network this column would list how much the provider was responsible for, because he is contracted to receive no more than the allowed amount.

This EOB for Mr. Smith shows the provider does not need to write-off anything.

This is because the provider listed on the claim is not in-network.

This is bad for Mr. Smith.

11. Reason Codes – if the provider was in-network there would be codes to explain any write-off, like references to contracted amounts.

12. Deductible – the amount applied toward meeting Mr. Smith's annual deductible.

13. Copay/Coinsurance – Copay is a set dollar amount, Mr. Smith has a $15 copay and there is no additional coinsurance.

14. Additional Member Responsibility – Amount Mr. Smith may have to pay.

Because this was processed as out-of-network the provider is not under any agreement to accept the allowed amount.

Mr. Smith has a potential bill of $489.11.

Had this been processed in-network he would have owed only $15 for the office visit copay.

♦ This must be challenged by calling the doctor's office and pointing out this mistake.

15. Reason Codes – describes why the plan paid what it did.

A brief explanation appears at the bottom left corner.

The codes state: (015) the bill is in excess of what the plan normally allows … $211.84 in excess for the Preventive Service.

For the EKG - (038) the amount of $30.85 is applied toward the deductible.

16. Amount Paid – the amount Mr. Smith's insurance paid.