Income

What is your income ?

Income is the key to qualifying for tax credits. Too little and you get nothing. Too much and you also get nothing.

How do you know how much you need? This is not as difficult as it may sound.

♦ The page Income - What counts? goes into the details for income.

It is very important to understand what your income target needs to be. You don't want to come up short. Going over is actually harder to avoid.

♦ The page Subsdy - Calculator goes into details about the premium tax credit and income levels.

At this page you will find a Marketplace calculator. It is located at the very bottom of the page.

It is provided courtesy of the Kaiser Family Foundation. You can enter various situations and get an estimate of possible premium tax credits. If you enter some numbers in the calculator on our web page and click submit, it takes you to Kaiser's site to see the results.

• The Kaiser Family Foundation calculator is a good tool to use to learn how close your household's income is to qualifying or not qualifying for premium credits.

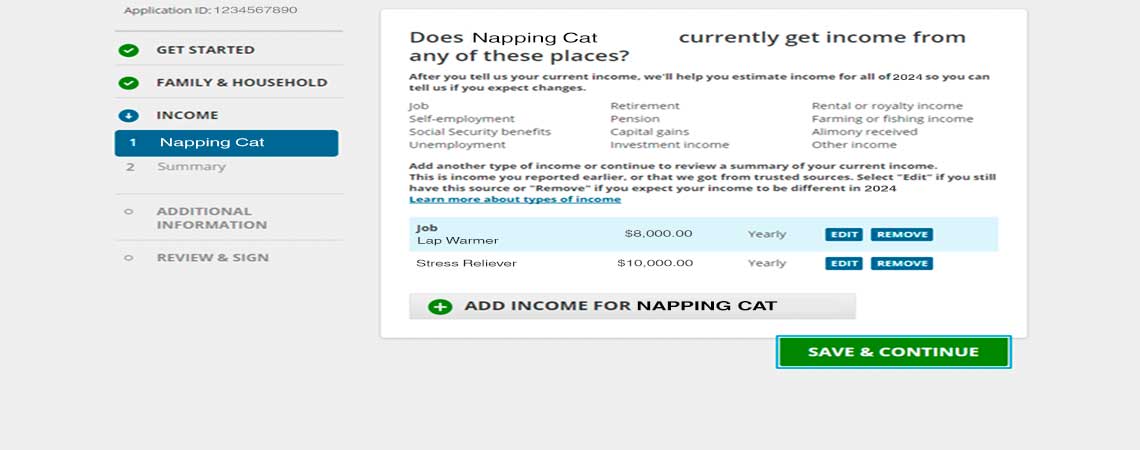

Income usually comes from a job. But income can come from investments, like dividends and interest. Pensions and even social security count as income.

A good starting point is last year's taxes.

You will need to report income for everyone in your household that you claim as a dependent when you file taxes.

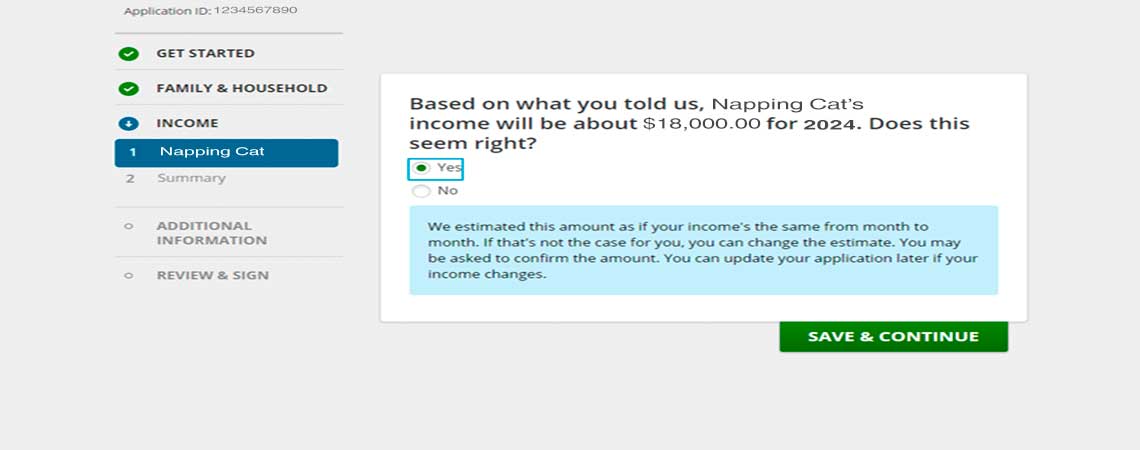

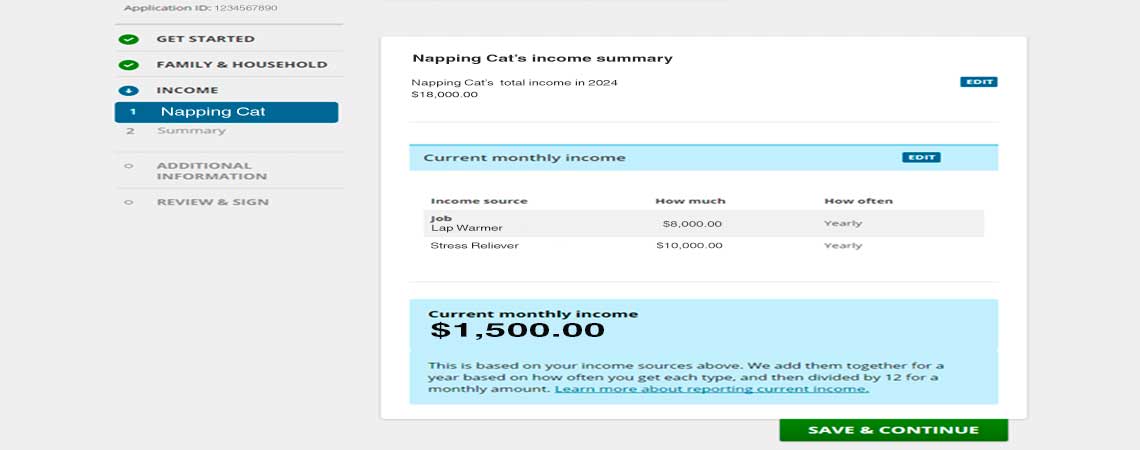

Income can be entered by the month or year. When you are done entering income the site will give you a total yearly income and an average monthly income. Review this number carefully to be sure it at least reaches the minimum amount for your household.

♦ If you do not reach the minimum amount, pause and rethink your income for next year. If possible, go back and add more income.